The Future of Clean Energy: How Republican Policies Could Reshape the IRA and Key Industries

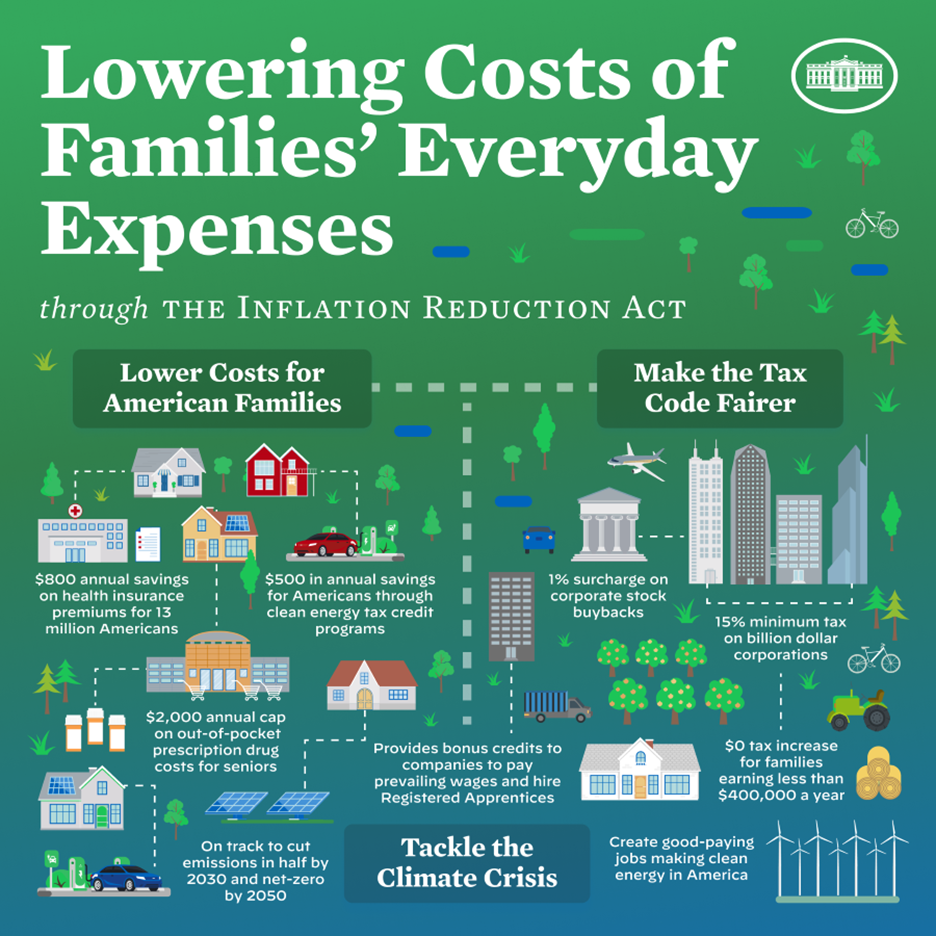

Whitehouse.gov, Public domain

The Inflation Reduction Act (IRA) of 2022 marked a turning point for the U.S. clean energy sector, allocating $391 billion in incentives to accelerate renewable energy production, support green manufacturing, and reduce greenhouse gas emissions. However, with a potential Republican-controlled government on the horizon—a scenario often referred to as a "Republican trifecta"—the fate of the IRA and its supported industries is uncertain.

While the IRA has brought significant economic and environmental benefits, its fiscal impact and ideological divergence with Republican priorities make it a prime target for repeal or modification. This blog explores how Republican policies might reshape the IRA, what industries are at risk, and how the clean energy sector can adapt.

The IRA has been instrumental in advancing clean energy, with measurable benefits:

Economic Impact: Red and purple states have reaped the lion’s share of IRA investments, with 42 manufacturing facilities established and 80% of EV-related investments flowing to these regions. These initiatives have bolstered job creation, particularly in regions transitioning from fossil fuel-based economies.

Climate Goals: The IRA's incentives aim to reduce greenhouse gas emissions by 40% by 2030, aligning the U.S. with its climate targets.

Industry Support: Sectors like solar, wind, hydrogen, and energy storage have received substantial funding, enabling rapid innovation and deployment.

Despite these achievements, the IRA faces criticism. Public awareness of its provisions is limited, with 26% of voters unaware of the act, and even among supporters, some express doubts about its implementation and scope. This lack of widespread understanding leaves the IRA vulnerable to political opposition.

Republican Critiques of the IRA

Republicans view the IRA as a costly overreach. Their opposition is rooted in three primary arguments:

1. Fiscal Concerns

The national debt has ballooned to over 120% of GDP, with projections showing continued growth. Republicans argue that the IRA’s $391 billion cost adds to this fiscal burden, making it unsustainable. Notably, the IRA’s cost is a fraction of the $1.9 trillion Tax Cuts and Jobs Act (TCJA) enacted under Republican leadership in 2017, highlighting a disparity in fiscal priorities.

2. Ideological Opposition

Republicans often criticize government intervention in markets, favoring private-sector-driven solutions. They argue that the IRA distorts market competition by heavily subsidizing certain industries, particularly solar and wind energy.

3. Political Strategy

Targeting the IRA aligns with Republican promises to reduce federal spending and lower taxes. Repealing or modifying the act could energize their voter base, especially in fossil fuel-dependent regions.

If Republicans succeed in reshaping the IRA, several clean energy sectors could face significant challenges:

a. Solar and Wind Energy: These sectors have thrived under the IRA’s tax credits, but they are among the most politically vulnerable. The repeal or reduction of these credits could stall new projects, particularly in states heavily reliant on federal incentives.

b. Hydrogen Production: Hydrogen, a cornerstone of the clean energy transition, has benefited from IRA funding. A rollback of these provisions could slow the development of hydrogen infrastructure, putting the U.S. at a competitive disadvantage globally.

c. Energy Storage and Grid Modernization: Energy storage is critical for integrating renewables into the grid, yet it remains highly dependent on IRA incentives. Scaling back these supports could delay advancements in battery technology and grid resilience.

d. Carbon Capture and Sequestration (CCS): While CCS enjoys bipartisan support, funding cuts could hinder large-scale projects, especially in sectors like cement and steel that rely on carbon capture to decarbonize.

e. Electric Vehicles (EVs): The IRA’s tax credits have spurred EV adoption, but scaling back these incentives could impact consumer demand and slow the auto industry’s transition to clean mobility.

Rather than outright repeal, Republicans may opt for a more nuanced approach to reshaping the IRA. Some strategies could include:

1. Phased Modifications

Republicans could phase out certain provisions over time. For instance, safe harbor strategies might protect existing projects while tightening rules for new ones.

2. Budgetary Offsets

In light of the TCJA’s impending expiration in 2025, Republicans might scale back IRA provisions to offset the cost of extending their tax cuts.

3. Targeted Adjustments

Some sectors, like nuclear and hydrogen, could see continued support due to their bipartisan appeal, while solar and wind face stricter eligibility criteria.

Interestingly, Republican-majority and swing states have been among the biggest beneficiaries of the IRA. Investments in clean energy manufacturing and EV production have revitalized local economies, particularly in areas transitioning from coal and other fossil fuels. This creates a political dilemma: repealing the IRA could alienate constituents who have directly benefited from its provisions.

A closer look at IRA-related investments shows that red and purple states account for 80% of EV-related initiatives and the majority of new manufacturing facilities. This underscores the economic benefits these regions stand to lose if the act is repealed.

Clean energy companies face several challenges amidst this uncertainty:

- Investment Risks: Companies may hesitate to commit to new projects if tax credits and incentives are at risk.

- Regulatory Complexity: Changes to Treasury guidance and eligibility rules could increase administrative burdens.

- Market Volatility: Uncertainty around policy changes could create demand fluctuations, complicating long-term planning.

While potential policy changes pose risks, they also create opportunities for innovation and adaptation:

1. Diversification: Companies can explore alternative revenue streams and markets less reliant on federal incentives.

2. Public-Private Partnerships: Collaborations with state governments and private investors could offset reduced federal support.

3. Advocacy: The clean energy sector can highlight the IRA’s economic and environmental benefits, especially in regions that have prospered under its provisions.

4. Focus on Resilient Technologies: Industries like hydrogen and CCS, which enjoy bipartisan support, could attract continued investment.

The clean energy sector stands at a crossroads. The IRA has catalyzed significant progress, but its future under a Republican trifecta is uncertain. By understanding the risks and preparing for potential changes, clean energy companies can position themselves for success in a shifting political landscape.

Ultimately, the clean energy transition is too important to derail. Whether through federal incentives, state initiatives, or private-sector leadership, the journey toward a sustainable future will continue. For stakeholders, staying proactive and adaptive will be key to thriving in this new era.

Are you a landowner? Would you like to contribute to a greener and sustainable future while earning a passive income? Get in touch with us today and learn how to.